Japanese Knotweed specialists since 2002

Founded by Mike Clough, Japanese Knotweed Solutions Limited (JKSL) is the UK’s longest established Japanese knotweed removal company.

Japanese knotweed is one of the most invasive plant species in the UK and can cause extensive damage to buildings and property. Our clients include construction companies, local authorities and residential developers, providing tailored strategies to manage and remove Japanese knotweed and other highly invasive non-native plants such as Giant hogweed and Himalayan balsam, across the UK.

Request a Quote

Trusted by

What Is Japanese Knotweed

Japanese knotweed, or Reynoutria japonica, is a fast-growing, invasive plant species native to East Asia. It was introduced to Europe and North America during the 19th century as an ornamental plant and for erosion control.

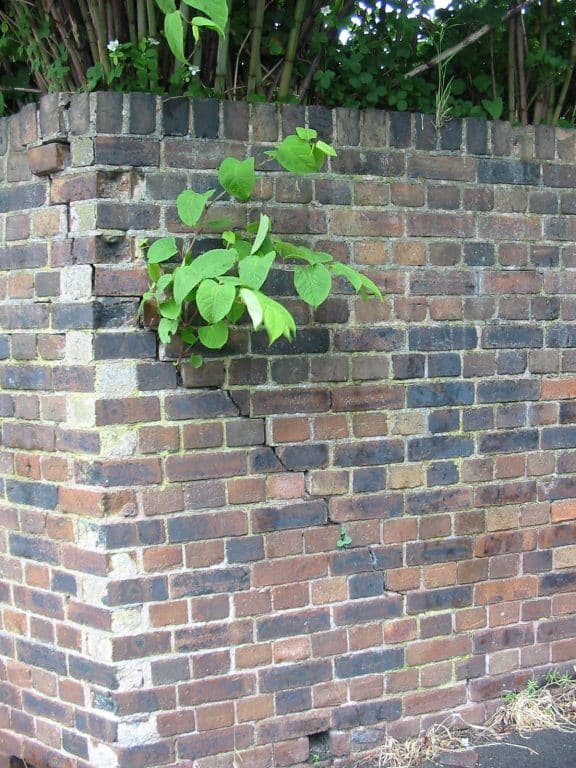

Japanese knotweed is an invasive plant and is known for its bamboo-like appearance with hollow stems and large, green, spade-shaped leaves. It produces clusters of small, white flowers in late summer and early autumn. However, it is it’s growth habits that cause concern.

Japanese knotweed spreads aggressively through its extensive root system, or rhizomes, which can spread up to 7 meters horizontally and 3 meters deep. This rapid and robust plant growth, can cause damage to building structures, pavements, and drainage systems. It can also outcompete native plants, leading to a decrease in biodiversity. This is why its imperative you use a Japanese knotweed specialist to identify and remove your Knotweed problem.

Identify your weed

Take a photo of the suspected Japanese knotweed and share it with our expert Surveyors. They will carefully examine the image and advise if it is Japanese knotweed.

Due to its destructive nature and the difficulty of fully eradicating it, Japanese knotweed is classified as an invasive species in several countries, including the UK and the US. It is illegal to allow this plant to spread in the UK as per the Wildlife and Countryside Act, and management and removal must be carried out by Japanese knotweed specialists to ensure successful treatment.

What to expect from JKSL

The first step is for one of our Japanese knotweed specialists to come out to your site to establish the extent of the problem via a Knotweed survey, before creating a full management plan to treat the Japanese knotweed problem. Based on environmental considerations we will choose what we believe the most effective treatment is to completely remove the Japanese knotweed infestation and to help ensure it doesn’t return in the future.

Request A Quote

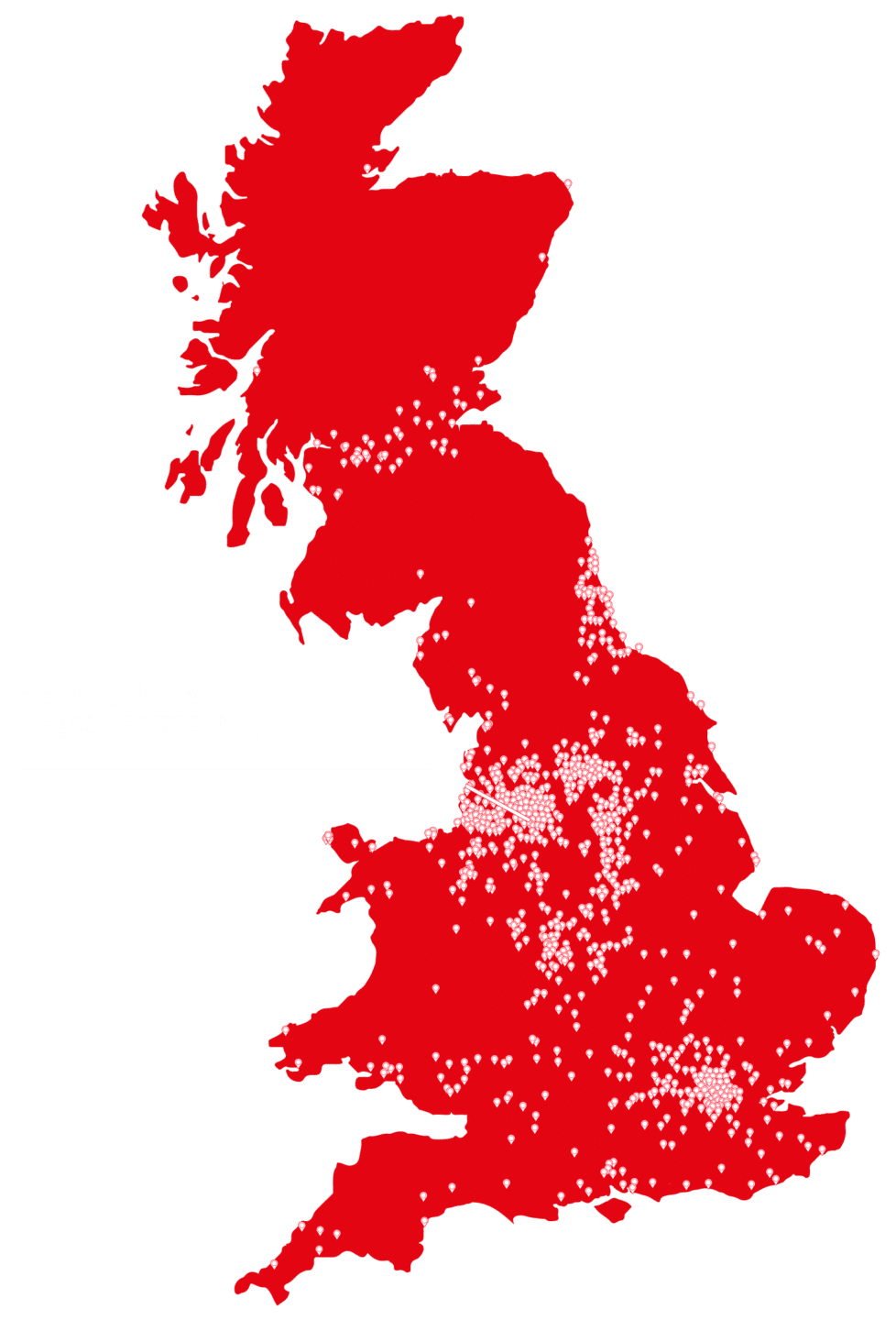

We Work All Across The UK

Japanese knotweed is an invasive non-native plant that is found all across the UK due to its rapid spread since its introduction. The map below shows some of our projects across the UK, having worked on a range of sites to eradicate and control Knotweed.

Our Knotweed Guarantee

Japanese knotweed treatment can be difficult and should be carried out by Japanese knotweed specialists, which is why all our treatments, can be fully insured for 10 years, giving peace of mind that the removal treatments we perform are completed safely and to the highest standards. We also have a comprehensive Japanese knotweed aftercare package we employ after every removal treatment, offering a full end-to-end service.

We can handle the entire process for you, from initial identification to full site review, implementing treatment methods and ensuring the removal of all Japanese knotweed traces from your site.

We’ve even been involved with the creation of MeshTech removal method, which sets the standard for controlling Japanese knotweed in a way that minimises environmental damage to the surrounding wildlife.

We believe that the removal of Japanese knotweed should only be done once and done right, so be wary of cheaper imitations.

“We have employed Japanese Knotweed Solutions on a number of sites in the Knowsley area. They have an excellent understanding of our requirements and they liaise with us in a professional yet informal way. Japanese Knotweed Solutions have also provided valuable training to a number of our staff and our partnership agency staff…”

Knowsley Housing Trust

Japanese Knotweed Removal

JKSL has spent over 20 years raising awareness about the impacts of this invasive species, as well as offering an innovative and highly effective range of treatments, for treating Japanese knotweed.

100% Success Rate

We operate around the country from our base in the northwest of England, providing a tailored removal service to hundreds of different clients. We can confidently guarantee a 100% success rate in traditional mechanical remediation methodologies in both domestic and commercial settings, with our Japanese knotweed experts able to deal with both small and large-scale industrial sites as required.

With our in-depth knowledge and research into getting rid of Japanese knotweed in the most environmentally conscious and lasting manner, we’re widely recognised as Japanese knotweed specialists, a level of expertise that has led to our work being highlighted by many media outlets, including the BBC.

Identify your weed

Don’t Let That Suspicious Weed Grow

contact us nowJapanese Knotweed Specialists Availability

Our response team is available 7 days a week, a move designed to allow us to cater to your Japanese knotweed identification and removal requirements as rapidly as possible.

As Japanese knotweed removal specialists, we are fully industry-accredited, providing a range of highly competitive pricing packages, coupled with the aforementioned 100% success rate guarantee and 10 year insurance-backed warranty options. This combination means that you can have full confidence and real peace of mind that when you’re using JKSL, your Japanese knotweed problem can be gone for good.

JKSL was founded when we realised the damage that was being caused around the country by Japanese knotweed. We wanted to create a specialist removal service who have a full understanding of the best ways to treat Japanese knotweed, so that we could offer the exact solution that each site needed. We offer an unrivalled combination of services and we are confident that we’ll be the ideal fit for anyone in need of reliable Japanese knotweed removal.

If you want to know more about how Japanese knotweed Solutions Ltd can help you with your identification, treatment or removal needs, then please don’t hesitate to get in touch with us today.

0161 723 2000

[email protected]

Our friendly and knowledgeable staff team are happy to speak to you in more detail about our specific services and how JKSL can best help you.

Our Accreditations

Since 2002, we have built an extensive library of industry accreditations and certifications. This helps to ensure both our level of expertise and also to provide reassurance in our implementation and professional approach to Japanese knotweed treatment.

As well as being members of trade bodies, INNSA (Invasive Non-Native Specialists Association) and the The Property Care Association (PCA), we also maintain The Amenity Standard and are part of the BASIS professional register and hold ISO 9001 and 14001 certifications.

Click the link below to see our full list of our industry accreditations.

view our accreditations

JK Connect

JK Connect is Japanese Knotweed Solutions’ proprietary system for managing the thousands of visits that we carry out each year, holding up-to-the-minute site data, providing alerts and other information to clients about our visits and collating and sending out our site inspection reports.

Learn More

Don’t Let That Suspicious Weed Grow

contact us nowBlog & News

Blog

Campaigns

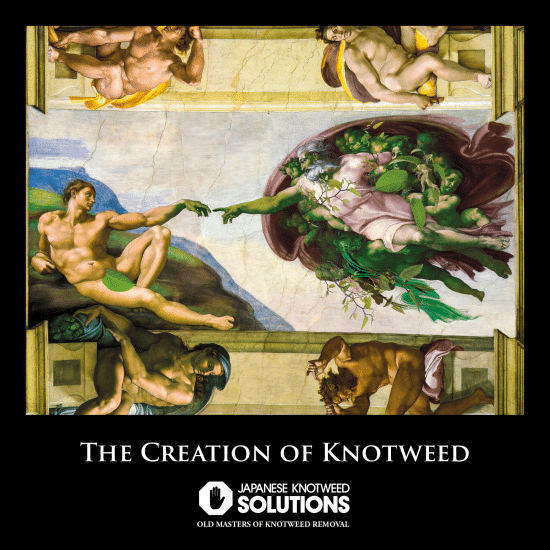

The Creation of Knotweed

The Creation of Knotweed (Italian: Creazione di Knotweed) c 1850, is a fresco painting by Italian artist Michelangelo. He became…

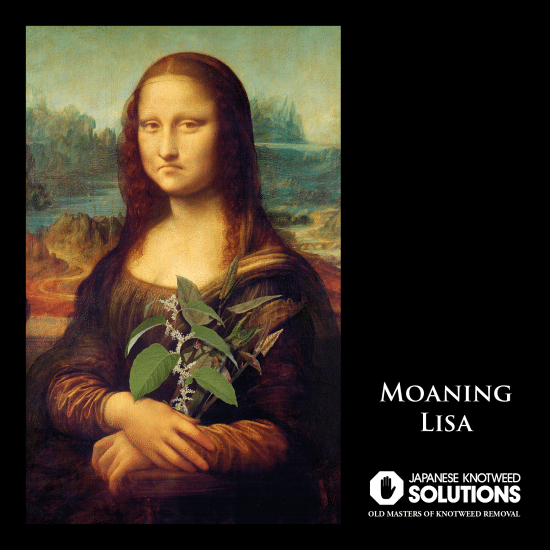

Moaning Lisa

The Moaning Lisa by Leonardo da Vinci, has been described as “The best known, the most visited, the most written…

Knotweed News

Knotweed News

Landfill Tax Increases – A Brake on Development

The landscape of waste management in the UK is shifting, with the government increasing landfill taxes as part of its…

F**king Cotoneaster

“F**king cotoneaster” is a phrase that many Land Managers might use today, but in the 1970s and 1980s ‘f**king cotoneaster’…

Mike Clough

Mike Clough

Inside JKSL

Inside JKSL

JKSL on BBC Radio Coventry & Warwickshire

JKSL’s Mike Clough speaks on BBC Radio Coventry & Warwickshire about Japanese Knotweed.

JKSL on ITV’s Tonight Programme

JKSL’s Mike Clough speaks to Alex Beresford about Japanese Knotweed.

Mike Clough on BBC Radio Berkshire

JKSL’s Mike Clough speaks to Anne Diamond on BBC’s Radio Berkshire about new Japanese Knotweed legislation.

Mike Clough on BBC Radio 5 Live

Mike Clough discussing Japanese Knotweed on the BBC Radio 5 Live Breakfast Show.